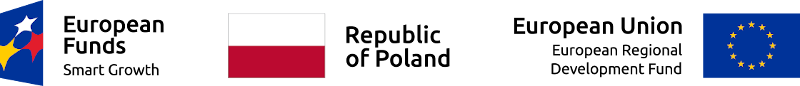

Cryptocurrency tax calculations, reporting, and portfolio management made simple.

Getting started with our cryptocurrency tax tool is so simple! All you need to do is register with your email address.

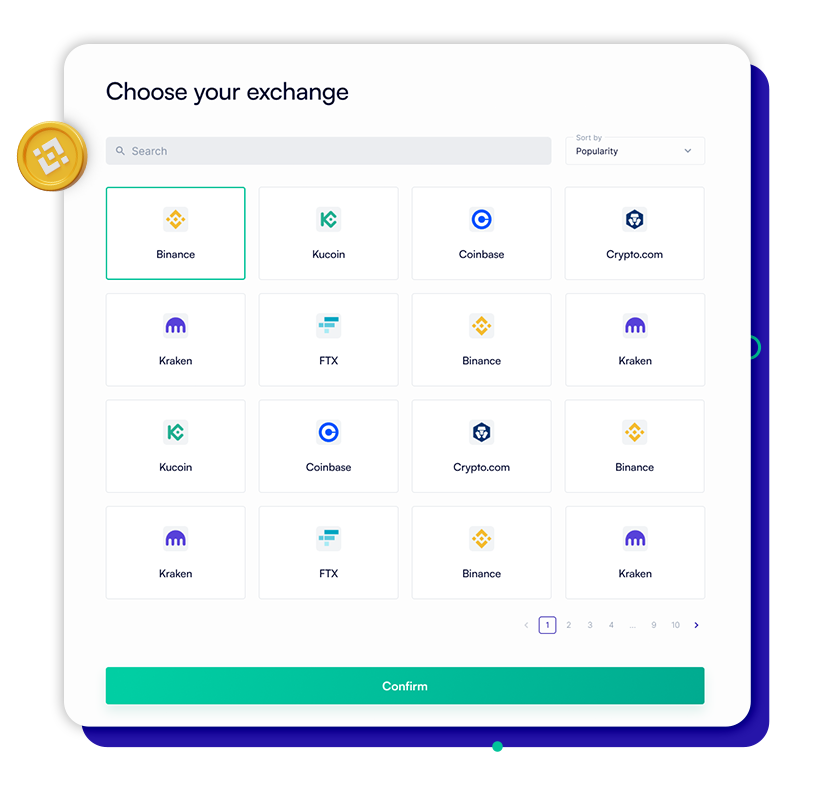

Easily add your exchange accounts via read-only API or CSV files and connect your blockchain wallets using public receiving addresses.

Review your transactions to ensure that you’ve imported everything correctly.

Instantly generate your tax report and get the cryptocurrency tax thing out of your head.

Access your data from the exchanges via API or via file import

Security

All sensitive data is encrypted using cryptographic algorithms. We do not collect your identification data.

Price

We offer a great quality at a good price, and you can get started for free.

Capable support

Our support team is real-life crypto experts who are ready to help you.

See what industry experts are saying about us

I used the Cryptiony app to settle my last tax year. With the Cryptiony app, tax return becomes fast, easy and fun. It is a product that automates tax return and saves a lot of time. I recommend it.

Automation of settlement of cryptocurrency transactions which made settlement from cryptocurrency transactions very SIMPLE. The intuitiveness of the application means that with minimal involvement you get ready-made statements of crypto operations for annual settlement for your accountant. I recommend it because Cryptiony makes life easier for every cryptocurrency trader including me.

The app allows you to integrate with cryptocurrency exchanges and prepare a tax report, which then transfers in minutes to the official annual tax return filed with the Tax Office. This greatly facilitates tax planning for clients.

The speed and ease of settlement with Cryptiony make the whole process less problematic than settling investments from the traditional market, despite a large number of operations.

Cryptiony allows for streamlining the process of customer service in accounting offices. It is suitable for both PIT-38 annual tax settlements for individuals and CIT-WW for businesses. What we used to count by hand for up to several days, now takes from a dozen minutes to a maximum of a few hours.

Yes, cryptocurrencies are taxed in most jurisdictions today. Thus you will have to pay taxes on your profits or claim losses. Cryptiony will help you to do it.

Yes, HMRC have confirmed that cryptoassets are taxable in the UK. Your crypto gains will be subject to Capital Gains Tax or Income Tax. The tax treatment depends on the type of activity.

Yes, crypto to crypto trades are classed as a taxable event and should be treated for Capital Gains Tax.

It's actually quite difficult to avoid crypto taxes. If your crypto gains fall above the annual exemption amount, you cannot avoid crypto tax in the UK. Every time you transfer funds to an exchange you are leaving a paper trail that tax agencies can catch on to. Non-compliance is fraud and you may be investigated by HMRC.

Yes, but it doesn't matter if you only made losses on cryptocurrencies, you still have to report it to your tax agency. Moreover, it is in your best interest to report crypto losses as they can be claimed against future Capital Gains.

Cryptiony automatically imports all your transactions, finds the fair market value for your assets at the time of each trade, calculates your Capital Gains/Losses and Income Taxes. You can download the tax report needed to file your self assessment or provide it to your accountant.

If you need to report and pay Capital Gains Tax, y

Cryptocurrencies remove the need for centralised i

© 2021-2023 | Cryptiony R&D sp. z o. o. | Cryptiony Ltd | All rights reserved.